Hawaii Solar Tax Credit Form

What s more with hawaii energy s rebate combined with state and federal tax credits you can save nearly 70 on the system purchase price in the first year.

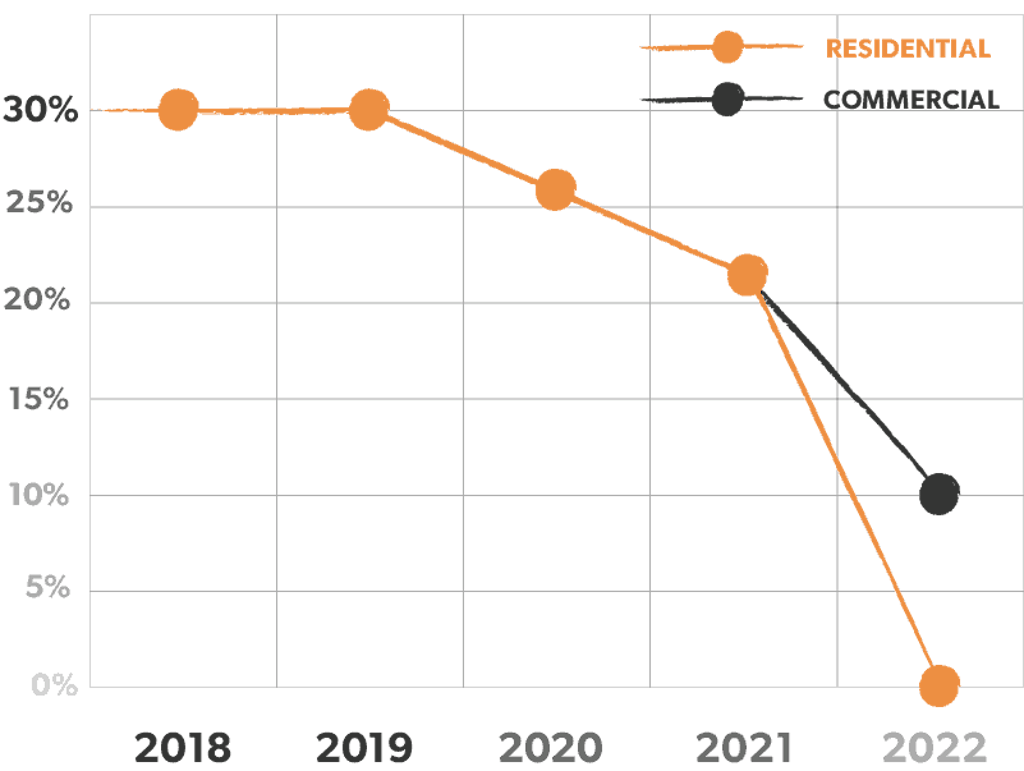

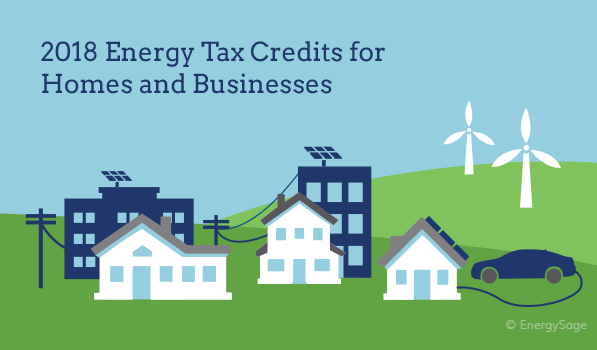

Hawaii solar tax credit form. The table below shows the value of the investment tax credit for each technology by year. The state of hawaii also offers at 50 75 rebate for solar attic fans via local utility companies. Use one form n 342 for each system. What is the solar tax credit in hawaii.

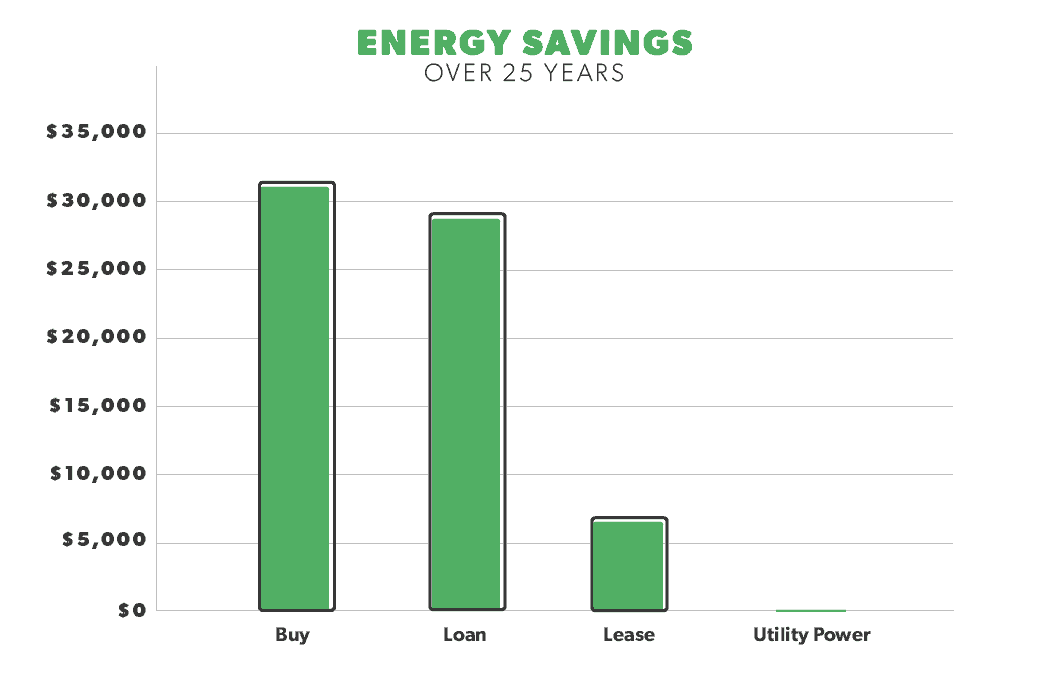

While buying a solar system outright will make you directly eligible for hawaii s solar tax credits and incentives you also have the option to lease your system from as little as 0 down our flexible leasing options pass down solar incentives in the form of a low predictable monthly. Reference sheet with hawaii tax schedule and credits. Tax information release no. Retitc forms shortcut to form n 342 and instructions form n 342a form n 342b and instructions and form n 342c and instructions.

Go solar your way with sunrun. All or part of the credits and the revocation of the election to composite file. Fast tax reference guide 2017 4 pages 227 kb 02 16 2018. Not bad just for putting up solar panels.

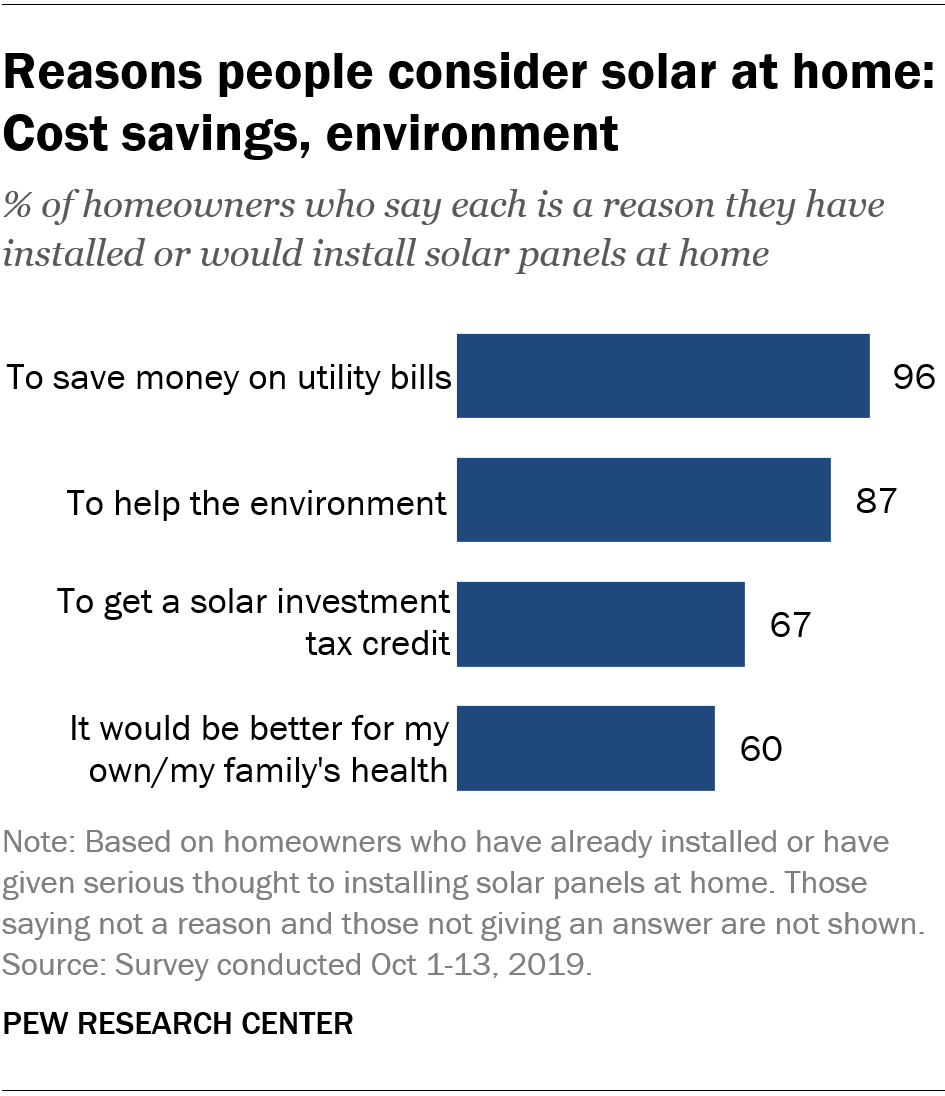

Since originally enacted in 1976 the hawaii energy tax credits have been amended several times. General instructions purpose of form use form n 342 to figure and claim the renewable energy technologies income tax credit retitc under section 235 12 5 hawaii revised statutes hrs. A summary of state taxes including information on tax rates forms that must be filed and when taxes must be paid. As we ve discussed on the hawaii solar incentives page here at hawaiisolarhq the tax credit in the aloha state is 35 of the cost of the solar installation or 5 000 whichever is less.

The hawaii solar tax credit allows homeowners to save up to 35 of the total cost of installing a solar pv system. Outline of the hawaii tax system as of july 1 2019 4 pages 59 kb 2 26 2020. The federal business energy investment tax credit itc has been amended a number of times most recently in december 2015. The nice part about credit is that it combines with the federal solar tax.

As a result of sb 855 in 2003 the tax credits were revised and extended to the end of 2007. 2012 01 pdf temporary administrative rules relating to the renewable energy technologies income tax credit retitc. Since a pv system is defined as 5 kw installing a more powerful system would mean you d have 2 systems installed. See tax return instruction booklet for more information.

At sunrun we understand that everyone s financial situation is different. The credit is applied the same year when the system is installed and it is limited to 5 000 per system per year.